Budget Briefing 2024

Budget 2024 – An Abundance of Tax Changes

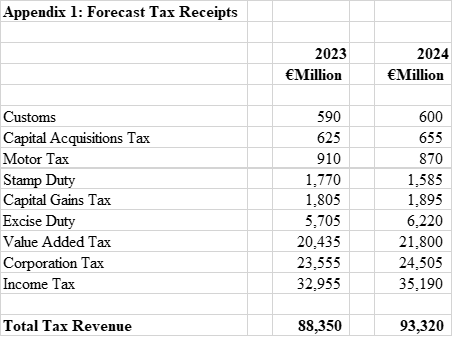

The penultimate pre-election budget contains a myriad of tax changes that impact businesses. Against a backdrop of corporation tax receipts which are forecast at €23.5 billion for the full year 2023 (€750 million below previous forecasts), two new funds have been put in place to secure the economy in the years ahead. The funds are as follows:

(a) The Future Ireland Fund, into which 0.8% of GDP will be contributed per annum from 2024 to 2035. This is forecast to be €4.35 billion in 2024. The fund is forecast to potentially grow to €100 billion by 2035.

(b) Infrastructure, Climate and Nature Fund, into which an annual contribution of €2 billion will be made for 7 years.

These funds have been formed to cover the cost of future capital infrastructure projects and to provide for the future costs of pensions and healthcare for an ageing population.

Ireland’s National Debt is forecast to reduce to €200 billion by the end of 2029.

The once-off measures to counteract inflation at circa. €2.7 billion are €1.7 billion less than the measures introduced last year. Inflation is forecasted to be 5.25% for 2023, reducing to 2.9% for 2024.

The minimum wage is to increase by €1.40 to €12.70 per hour from 1 January 2024.

Tax Measures

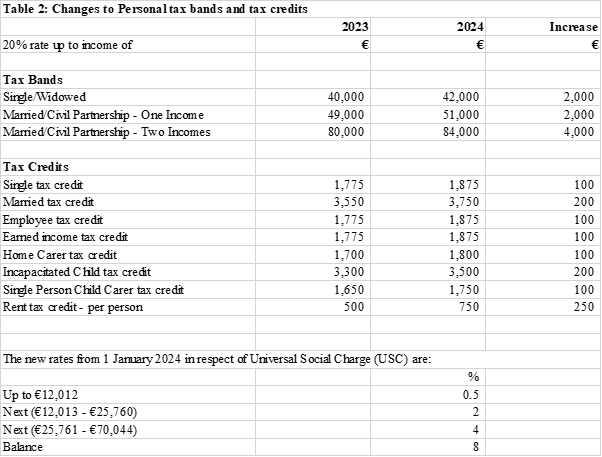

There is a €1.1 billion package focused on increasing the entry point to the 40% rate of income tax and reductions to Universal Social Charge (USC). The tax package announced today includes the following:

Capital Gains Tax (CGT)

- Retirement Relief – The age restriction has been extended to age 70 with an effective date from 1 January 2025. However, there will be a new limit of €10 million on disposals to a child from 1 January 2025.

- New targeted CGT relief for angel investors for investments in startup SMEs for a minimum of 3 years. The investment must be a minimum of €10,000 and must constitute between 5% and 49% of the ordinary share capital of the company. Qualifying investors may avail of an effective reduced rate of CGT of 16%, or 18% if through a partnership, on a gain of up to twice the value of their initial investment. There is a lifetime limit of €3 million on gains on which the reduced rate of CGT applies.

- A review of Entrepreneur Relief is to be carried out to focus the relief on improving the incentives available.

Income Tax

Mortgage Interest Relief

Introduction of targeted mortgage interest tax relief for one year of up to €1,250. Aimed at those whose primary principal residence is situated in the State and whose mortgage balances were between €80,000 and €500,000 on 31 December 2022. The taxpayer must be compliant with Local Property Tax (LPT) requirements. Relief will be granted on the increase of interest paid for 2023 over 2022 at the standard rate of income tax but capped at €1,250 per property. Mortgage interest relief was removed from 31 December 2020. Under the old relief, the financial institutions credited borrowers with the relief. Under the new scheme, the borrower must apply to Revenue for the tax credit.

Benefit in Kind (BIK) – Electric Vehicles

The tapering of preferential BIK relief in respect of electric cars has been suspended. When an electric vehicle is made available to an employee during 2024, for BIK purposes, the Original Market Value (OMV) of electric vehicles or vans will be reduced by €45,000 (2023 – €45,000). Any balance is subject to BIK at the relevant rate. For 2024, the OMV of non-electric vehicles and vans will be reduced by €10,000.

Residential Landlords

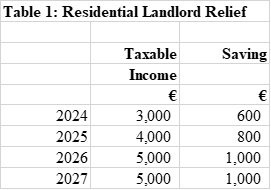

A new temporary tax relief has been introduced for small residential landlords whose tenancies are either registered with the Residential Tenancies Board or the residential property is let to a public authority. Subject to certain conditions, rental income of €3,000 in the tax year 2024, €4,000 in the tax year 2025 and €5,000 in tax years 2026 and 2027 will be disregarded at the standard rate. There will be a clawback of the full tax relief claimed if the landlord leaves the rental market within the 4 years. Full details to be provided in the Finance Bill.

Other Tax Changes

- Reduced rates of USC for those holding a medical card with earnings of less than €60,000 has been extended to the end of 2025.

- Tax credit to support tenants increased from €500 per person to €750 for 2024 and subsequent years. The credit has been extended to those parents who pay rent on behalf of their student children under rent-a-room schemes and digs accommodation. This extension has been backdated for the 2022 and 2023 tax years.

- The Help to Buy Scheme, which was due to expire at the end of 2024, has been extended to the end of 2025. It provides for a refund of Income Tax and DIRT of up to €30,000 on the purchase of a new house by first time buyers. The scheme is also being amended to reflect its interaction with the Local Authority Affordable Purchase Scheme. This amendment is effective from 11 October 2023.

- Personal income of €400 will be disregarded for tax purposes for the sale of electricity back to the grid during 2024. No USC or PRSI applies.

Business Tax Changes

- Participation Exemption for foreign source dividends to be introduced with legislation in Finance Bill 2024, subject to consultation at present.

- Employment Investment Incentive (EII) – standard holding period to be 4 years and the investment on which tax relief can be claimed in the year is capped at €500,000 per annum. A further review of EII relief will take place in 2024.

- Key Employee Engagement Programme (KEEP) – EU State Aid approval has been obtained to put in place the 2022 amendment which doubles the market value of share options issued, but unexercised, from €3 million to €6 million. KEEP has been extended to 31 December 2025.

- Section 481 Film tax credit – qualifying expenditure increased from €70 million to €125 million, subject to State Aid approval. Further incentives for the unscripted production sector are to be introduced.

- Accelerated Capital Allowances Scheme for Energy Efficient Equipment extended for a further 2 years to 31 December 2025.

- Pre-trading expenditure incurred by a company in the carrying on of Research and Development activities can be claimed as a payable tax credit and will be refundable in three annual instalments from the first accounting period in which the company commences to trade. The first instalment currently equals the greater of €25,000 (or the credit claimed if lower), or 50% of the amount of the credit claimed. The budget increases the first-year payment threshold from €25,000 to €50,000.

- From 1 October 2024, all PRSI contribution rates will increase by 0.1%.

- Vehicle Registration Tax (VRT) relief is extended to the end of 2025 for battery electric vehicles with a value up to €50,000. Extension applies from 11 October 2023.

- A revised bank levy is being introduced for 2024. It will have a Revenue target of €200 million.

- A dedicated Tax Administration Liaison Committee (TALC) subgroup is to be set up to look at simplifying business supports.

- Further consultation on share-based remuneration during 2024 is promised.

- Funds sector review due to report in Summer 2024 on the Life Assurance Exit Tax, and the taxation of funds, including ETF’s, for Irish investors.

Value Added Tax (VAT)

- 9% VAT rate on electricity and gas which was due to expire on 31 October 2023 has been extended to 31 October 2024.

- No reduction in the lower 13.5% rate on hospitality/construction sectors.

- VAT registration thresholds are to increase from €37,500 to €40,000 for services and from €75,000 to €80,000 for goods with effect from 1 January 2024.

- VAT rate of e-books and audio books reduced from 9% to 0% from 1 January 2024.

- Unregistered flat-rate farmers VAT rate will reduce from 5% to 4.8% from 1 January 2024.

- Revenue will launch a public consultation on how best to use digital advances to modernise VAT invoicing and reporting.

Capital Acquisitions Tax (CAT)

Foster children to benefit from Group B threshold of €32,500, based on their relationship with foster parents. No other changes to CAT.

Heritage Items

A donation of an important national heritage item qualifies for a tax credit equal to 80% of its market value. The budget increases the threshold for tax relief from €6 million to €8 million. The tax credit can be offset against income tax, corporation tax, capital gains tax and capital acquisitions tax.

Residential Zoned Land Tax (RZLT)

RZLT, a 3% annual tax to be levied on the market value of all residential zoned and serviced sites within its scope, was first introduced in Finance Act 2021. The first payment date for this tax was due to be 23 May 2024. This payment date has now been postponed by one year to facilitate further engagement by landowners with local authorities in relation to the mapping process.

Vacant Homes Tax

The Vacant Homes Tax, introduced in last year’s budget, applies to homes that are occupied for less than 30 days over the last 12 months. The tax will be charged at a rate equal to five times the property’s existing basic LPT rate (increased from three times the basic LPT rate) from November 2023. This is in addition to the LPT payable on the property.

Farmers

- Consanguinity Relief extended for a further 5 years (which reduces the rate of Stamp Duty on transfers of farm land from 7.5% to 1% between family members).

- Accelerated Capital Allowances of 50% per annum on farm safety equipment extended to 31 December 2026.

- Lifetime limit on stock relief for young trained farmers, relief for succession farm partnerships and young trained farmer stamp duty relief is being amended to increase the aggregate lifetime amount of relief available to a person under these reliefs from €70,000 to €100,000 from 1 January 2024.

- The Land Leasing income tax relief will be amended so that it will only become available when the land has been owned for 7 years so that it is better targeted towards active farmers.

Excise Duties

Carbon Tax

The planned increase on excise duties on petrol, diesel and gas/oil for 31 October 2023 will be delayed from 31 October 2023 to 1 April 2024 and 1 August 2024, with two equal instalments of the planned increase of €0.08 for petrol, €0.06 for diesel and €0.03 for gas/oil. However, Carbon tax will be raised from €48.50 per tonne to €56 per tonne from 11 October 2023 for petrol and diesel, with home heating oil to increase in May 2024.

Non-Carbon Tax

Energy rebates up to €450 split across three payments, with a €150 payment before Christmas and two further payments of €150 in early 2024.

Excise duty on a pack of 20 cigarettes increased by €0.75. New domestic tax to be introduced next year on vaping and e-cigarette products. No change to excise duties on alcohol.

New Revenue reporting requirements for tax-free payments to employees.

While not part of the Budget 2024, please note, where employers make travel and subsistence payments, small benefits (vouchers up to €1,000) and remote working allowances to employees, they will be required to submit details of these payments in advance to Revenue from 1 January 2024.

The detail in the Budget and other amendments to tax legislation will be contained in the Finance Bill 2023 which is due to be published on 19 October 2023. However, please note some legislation will be passed tonight by Financial Resolutions.

This summary is intended as a general guide. No action should be taken without obtaining professional taxation advice.

If you have any queries, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700 or email your usual PMQ contact.

Purcell McQuillan Tax Partners Limited 10 October 2023

Copyright © *2023 Purcell McQuillan Tax Partners Limited, All rights reserved.