Budget Briefing 2025

Budget 2025

Minister Jack Chambers delivered his first Budget this afternoon, 1 October 2024. While it is his first Budget, it is the current Government’s last one as a general election must be held before March 2025. The strong corporation tax receipts again exceeding forecasts together with the Apple ruling from the ECJ gave the Government the platform to do as much as they felt was needed at this time. The total Budget package is €10.5 billion.

Personal Tax Measures

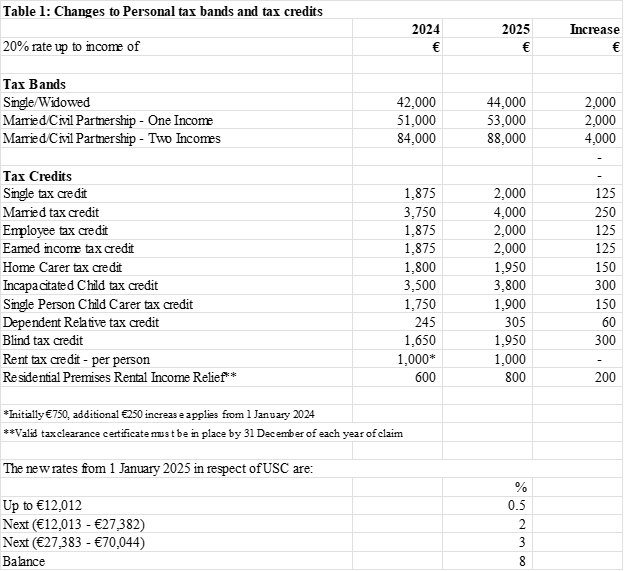

There is a €1.6 billion package in respect of personal income tax measures focused on increasing the entry point to the 40% rate of income tax and reductions to Universal Social Charge (“USC”). The personal income tax package announced today includes the following with effect from 1 January 2025:

- An increase of €2,000 in the standard rate cut-off point from €42,000 to €44,000

- An increase of €125 in the personal tax credit, PAYE credit and earned income credit

- An increase of €150 in the home carer tax credit and single person child carer credit

- An increase of €300 in the incapacitated child tax credit

- An increase of €60 in the dependent relative tax credit

- An increase of €300 in the blind tax credit

In addition, the rent tax credit was topped up by €250 from 1 January 2024, meaning the total credit for 2024 will now be €1,000. The credit will also apply for 2025 at €1,000.

Benefit-in-Kind (“BIK”) – Motor Vehicles

In 2023, a relief of €10,000 was introduced for all company cars for BIK purposes. This has been extended for a further year to the end of 2025. The Minister noted that for qualifying electric vehicles there will be an overall relief of €45,000 for 2025.

The Minister is providing for a BIK exemption for the provision of electric vehicle chargers at employee’s and director’s homes.

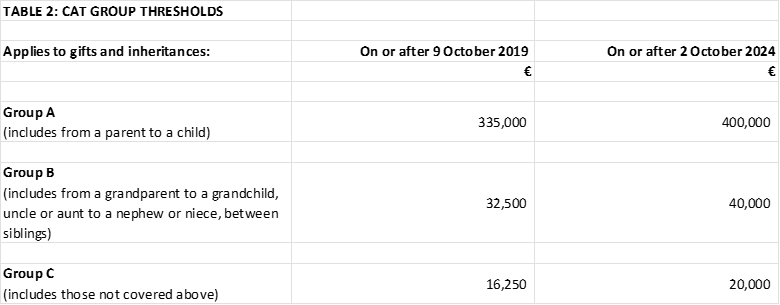

Capital Acquisitions Tax (“CAT”)

The lifetime tax-free CAT thresholds that have been in place since 9 October 2019 have been increased as follows:

Capital Gains Tax (“CGT”)

Retirement relief was to be capped at €10 million on the market value of qualifying assets transferred to children from 1 January 2025 for those aged between 55 and 69. This limit has been abolished and replaced with a clawback mechanism that only applies tax if the business is sold outside of the family within 12 years of it being transferred to the children.

The Minister did not refer to the cap of €3 million for those aged over 70.

Measures to Support Business

The Minister signalled a new Participation Exemption scheme for Foreign Dividends to simplify existing double tax relief provisions. The new scheme will apply from 1 January 2025 and corporates can choose between the existing tax credit system or the new system in their annual tax return. The new provision will provide an alternative method of double tax relief for dividends received from subsidiaries in EU/EEA states and countries with whom Ireland has a double taxation agreement.

The Minister announced a review of the Research and Development (“R&D”) Tax credit. In the interim, the first-year payment threshold for the R&D tax credit will increase from €50,000 to €75,000. The threshold is the amount up to which a claim can be paid in full in the first year, rather than being paid in instalments over three years.

He extended the Employment Investment Incentive for a further two years and doubled the amount an investor can claim relief on from €500,000 to €1,000,000.

He increased the relief available under the Start-Up Relief for Entrepreneurs from €700,000 to €980,000 and also extended the relief for two years. He also extended the Start-Up Capital Incentive for a further two years to the end of 2026.

Budget 2024 introduced a new CGT relief, called “relief for investment in innovative enterprises” but which is referred to by many commentators as relief for “Angel investors”. Where the conditions for the relief are satisfied the rate of CGT payable on a disposal of shares is reduced to 16% (or 18% where the investment is made by a qualifying partnership). The lifetime limit on gains, to which the Capital Gains Tax Relief for angel investors, was increased to €10 million from €3 million. The relief will commence shortly.

The Minister enhanced the S.486C small company start-up relief from corporation tax through extending the scope of the relief to small owner-managed start-up companies.

The Minister announced the introduction of a new tax deduction for expenses incurred in connection with a successful first listing on an Irish or European stock exchange subject to a cap of €1 million.

Subject to State Aid rules, the Minister will introduce a Stamp Duty exemption to enable Irish SMEs to access equity via financial trading platforms.

Small Benefit Exemption

The Small Benefit Exemption currently allows an employer to provide up to two non-cash benefits to employees worth up to €1,000 in total in one calendar year without the payment of income tax, PRSI or USC. This has been increased to five separate benefits up to €1,500 in total.

Mortgage Interest Tax Credit and Help to Buy Scheme

The Mortgage Interest Tax Credit introduced in last year’s budget for taxpayers who have made payments in respect of a qualifying loan for a principal private residence has been extended to the 2024 tax year. The maximum tax credit available is €1,250 (Maximum interest increase of €6,250*20%).

The Help-to-Buy scheme has been extended to 31 December 2029. This allows first time buyers who are purchasing a new home to claim up to €30,000 back from Revenue in income tax that they paid over the past four years.

Donations to Sporting Bodies

Currently only self-assessed individuals are entitled to a deduction in respect of donations made to an approved sports body. PAYE taxpayers do not receive tax relief on their donations but the sporting body can claim a refund of the income tax paid by the donor. The Minister has announced that this will change and both PAYE and self-assessed individuals can choose for themselves whether to claim the relief or allow for the tax relief to go to the sporting body.

Arts

The Minister introduced a new tax credit for Unscripted Productions subject to European Commission approval. The credit will be available at a rate of 20% on qualifying expenditure up to €15 million. The project will be required to pass a cultural test.

He also announced a new 8% uplift under S.481 film tax credit for feature film productions with a maximum qualifying expenditure of €20 million.

Farming

The Minister announced the extension of General Stock Relief, Stock Relief for Young Trained Farmers and Stock Relief for Registered Farm Partnerships to the end of 2027.

He broadened the scope of accelerated capital allowances for farm safety equipment by adding further farm safety equipment types.

He also announced that he is amending both the Young Trained Farmer Stamp Duty Relief and the stamp duty relief which applies to farmers who lease land to allow them to carry on their business through a company.

He announced the extension of the six-year active farmer test in CAT Agricultural Relief to the person who provides the gift or inheritance to prevent the misuse of the relief.

He announced the increase of the Farmers flat rate compensation from 4.8% to 5.1%.

Value Added Tax (“VAT”)

There is no change to the VAT rate for the hospitality industry.

The VAT registration thresholds will increase from €40,000 to €42,500 for services and from €80,000 to €85,000 for goods from 1 January 2025.

The 9% reduced VAT rate for gas and electricity will be extended for another 6 months to 30 April 2025.

Residential Zoned Land Tax (“RZLT”)

RZLT, a 3% annual tax to be levied on the market value of all residential zoned and serviced sites within its scope, was first introduced in Finance Act 2021. The first payment date for this tax was due to be 23 May 2024 and was postponed by one year in last year’s Budget to 23 May 2025. This payment date will remain but landowners who carry out genuine economic activity on their land may seek to have their land rezoned to reflect the activity they carry out on their land.

Stamp Duty

New Rate – Residential Property

A third rate of Stamp Duty on residential property will apply where the acquisition price is in excess of €1.5 million. Stamp Duty at 1% will apply up to €1 million, 2% between €1,000,001 and €1,500,000. A rate of 6% will apply about the value of €1.5 million. The Minister indicated that normal transitional arrangements will apply for transactions in process.

Bulk Purchase

The rate of Stamp Duty applicable to the purchase of 10 or more residential houses has been increased from 10% to 15% with effect from midnight on 1 October 2024.

Excise Duties

Excise duty on a pack of 20 cigarettes increased by €1 with a pro-rata increase on other tobacco products. New domestic tax on vaping and e-cigarette products will be introduced with a €0.50 tax per ml of e-liquid from mid-2025.

Other Measures

- The auto enrolment pension scheme will commence from 30 September 2025.

- Finally, as announced in last year’s Budget the main PRSI rates increase from 4% to 4.1% for employees and 11.05% to 11.15% for employers from today

The detail in the Budget and other amendments to tax legislation will be contained in the Finance Bill 2024 which is due to be published on 10 October 2024. However, please note some legislation will be passed tonight by Financial Resolutions.

This summary is intended as a general guide. No action should be taken without obtaining professional taxation advice.

If you have any queries, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700 or email your usual PMQ contact.

Purcell McQuillan Tax Partners Limited 1 October 2024

Copyright © *2024 Purcell McQuillan Tax Partners Limited, All rights reserved.